A Typical Lending Opportunity:

My client who has a 700 credit score is attempting to purchase a 100% leased strip shopping center in Live Oak, Texas. When I asked them why, they told me the center is not in a Tier #1 market; so they have no interest in the loan.

What do I do now?

If your Borrower has a great piece of Real Estate in a prime location such as Manhattan you may not need us…

However, if their unfunded project is in a secondary or tertiary market like:

| • Galena, OH • Reading PA • Bonita Springs, FL • Midland, TX • Greenville, SC • Pepperell, MA • Mission, TX |

• Moorhead, MN • LaGrange, IN • Tulsa, OK • Baton Rouge, LA • Sunbury, PA • Niagara Falls, NY • Louviers, CO |

• Detroit, MI • Wildwood,NJ • Winchester, IL • Andrews, TX • Minot, ND • Live Oak, TX • Flint, MI |

…or anywhere else in our Great Country considered

“NOT TIER ONE”

Contact Quaker State Commercial Finance

We have closed difficult commercial loans in these cities and many other similar cities in these United States of America.

You need Quaker State to close your loan and earn your fee!

OUR PROCEDURES

The Following is to give any prospective client/borrower an understanding of the typical process involved with most loan programs...

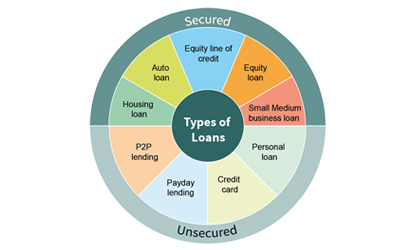

LOAN TYPE

Quaker State provides business financing for small, moderate and large size businesses where more creative, flexible, and/or aggressive...

CLOSED LOAN

Quaker State capabilities include conventional, SBA and hard money financing for apartment complexes, shopping centers, office...

Contact Info

You can contact or visit us in our office from Monday to Friday

- 1950 Butler Pike, #137, Conshohocken, PA., 19428

- 610.667.6701866.593.6320

- quakerstatemortgage@gmail.com